A New Saudi AI Research Initiative: Integrating Supervised and Unsupervised Machine Learning Models to Combat a $500 Billion Global Tax Fraud Issue

Tax fraud is a global problem that poses a significant challenge for governments worldwide. The deliberate manipulation of information in tax returns to reduce tax liabilities leads to immense financial losses annually. To combat this issue, tax authorities are increasingly turning to machine learning models to enhance their fraud detection capabilities. In particular, a new Saudi AI research initiative is making significant strides in integrating supervised and unsupervised machine learning models to combat a $500 billion global tax fraud issue. This innovative approach aims to overcome the limitations of traditional strategies and offer a more comprehensive and accurate method for detecting tax fraud.

🔥Explore 3500+ AI Tools and 2000+ GPTs at AI Toolhouse

The Limitations of Current Strategies

Current tax fraud detection strategies mainly rely on either supervised or unsupervised machine learning models. Supervised models rely on previously audited tax returns to identify patterns and predict fraudulent activities [1]. While these models can achieve high accuracy, they suffer from sample selection bias due to limited labeled data. On the other hand, unsupervised models analyze the entire dataset without distinguishing fraudulent from non-fraudulent returns. However, these models can struggle to effectively detect fraud independently [4].

Introducing a Novel Approach

To address the limitations of current strategies, a research paper from King Saud University in Riyadh proposes a novel tax fraud detection machine learning framework. This framework combines supervised and unsupervised models, utilizing ensemble learning paradigms to enhance fraud detection [1]. The researchers also incorporate newly engineered features into the framework, demonstrating its effectiveness through testing on tax returns provided by the Saudi tax authority.

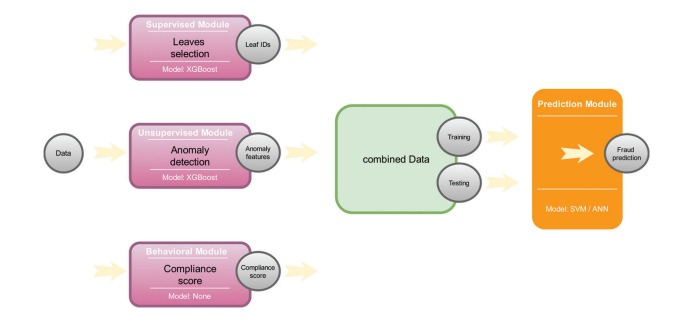

Four Modules for Enhanced Fraud Detection

The proposed tax fraud detection framework consists of four modules, each contributing to the overall accuracy and effectiveness of the system:

- Data Preprocessing: This module focuses on cleaning and preparing the tax data for analysis. It involves handling missing values, standardizing variables, and transforming data to ensure compatibility with the machine learning algorithms.

- Supervised Learning: In this module, supervised machine learning algorithms such as XGBoost, autoencoders, Artificial Neural Networks (ANN), and Support Vector Machines (SVM) are employed. These models learn from labeled tax returns to identify patterns and predict fraudulent activities.

- Unsupervised Learning: The unsupervised learning module aims to identify anomalous patterns in the tax data without relying on labeled examples. Unsupervised anomaly detection techniques, such as autoencoders, are utilized to flag potentially fraudulent tax returns.

- Ensemble Learning: The ensemble learning module combines the outputs of the supervised and unsupervised models to make a final prediction. This integration improves the overall accuracy and robustness of fraud detection.

Evaluation and Results

The researchers evaluated the proposed approach using data from the Saudi Zakat, Tax, and Customs Authority. They employed XGBoost, autoencoders, ANN, and SVM algorithms and considered precision as the primary metric, along with other metrics such as recall, F1 score, and accuracy. The results of the evaluation study indicated that the ANN model slightly outperformed SVM in predicting the “fraud” class, demonstrating high precision [1].

The proposed framework showed significant improvements over models using only original data, except for recall on the “not fraud” class using SVM. Hyperparameter experiments in ANN and SVM resulted in slightly inferior performance compared to the best-performing model. Despite these limitations, the overall results of the evaluation study were promising and showcased the potential of the integrated supervised and unsupervised machine learning approach for tax fraud detection [1].

Incorporating Compliance Scores for Enhanced Detection

To further enhance fraud detection, the researchers incorporated the compliance scores of taxpayers into the framework. These scores aided in coverage assessment and implementation of an audit selection strategy. By considering taxpayer compliance behavior, the framework can better identify potential fraud cases and allocate audit resources more effectively [1].

However, it is important to note that the framework assumes homogeneous behavior within sectors and may encounter challenges with taxpayers having compliance scores close to zero. These limitations highlight areas for further research and improvement in the future.

A Paradigm Shift in Tax Fraud Detection

In conclusion, the integration of supervised and unsupervised machine learning models, along with compliance scores, offers a promising approach to combat the global tax fraud issue. The research initiative from Saudi Arabia showcases the potential of this innovative framework in accurately detecting tax fraud and overcoming the limitations of traditional strategies.

By leveraging the power of artificial intelligence and machine learning, tax authorities can significantly enhance their capabilities in identifying and preventing fraudulent activities. This new Saudi AI research initiative provides a potential paradigm shift in tax fraud detection that can be adopted globally, safeguarding government revenues and promoting fair tax compliance.

The development of advanced machine learning models and the continuous improvement of frameworks like the one proposed by the researchers at King Saud University will play a crucial role in combating tax fraud and ensuring the integrity of tax systems worldwide.

Check out the Paper. All credit for this research goes to the researchers of this project. Also, don’t forget to follow us on LinkedIn. Do join our active AI community on Discord.

If you like our work, you will love our Newsletter 📰